Year End Season of Giving

Support affordable housing as we close out 2025.

With a shortage of more than 7 million affordable homes in the United States, we must utilize every tool to promote the preservation of existing affordable housing, in addition to constructing new affordable housing, to address the nation’s housing crisis. The 4 percent Low Income Housing Tax Credit (Housing Credit) has played a critical role in financing the acquisition and rehabilitation of affordable housing.

National Housing Trust has released a policy brief providing insight into whether HFAs are explicitly encouraging preservation through the 4 percent credit. The brief is based on a review of 53 Qualified Allocation Plans (QAPs) released before December 2024 and interviews with several HFA staff and industry practitioners. Our analysis examines how state-level implementation practices and bond allocation structures shape the use of the 4 percent credit for preservation, focusing on both written preservation policies in QAPs and broader administrative practices such as application deadlines, threshold requirements, bond cap constraints, and competitiveness.

Though it provides a smaller subsidy than the 9 percent credit, the 4 percent credit remains a valuable tool in maintaining the long-term affordability and housing quality of existing affordable housing. Anecdotal evidence suggests that the use of the 4 percent credit for preservation1 has increased, with affordable housing developers reporting that state and/or local Housing Finance Agencies (HFAs) are actively encouraging or requiring preservation projects to use the 4 percent credit over the 9 percent credit. However, it remains unclear to what extent.

Below is an excerpt from NHT’s Infobrief on Preservation and the 4 Percent Housing Credit.

The Housing Credit program offers two types of tax credits. The 9 percent credit is awarded through a competitive process and covers up to 70 percent of a project’s costs, making it a good fit for new construction or substantial rehabilitation of affordable housing. The 4 percent credit offers a smaller subsidy - covering about 30 percent of costs - and must be paired with tax-exempt Private Activity Bonds (PABs). Although the 4 percent credit has historically been considered a noncompetitive “as-of-right” resource, its use is effectively constrained by PAB availability and differences in state-level administrative processes. Each state establishes its housing priorities through a written Qualified Allocation Plan (QAP), which shapes how both credits are allocated, however, QAP policies alone do not fully reflect how those priorities are implemented. How the 4 percent credits are used in practice depends on the availability of PABs, as well as how states structure access to PABs and manage their allocation processes. Read more about the connection between the 4 percent credit and Private Activity Bonds in our Infobrief here: https://nationalhousingtrust.org/strengthening-low-income-housing-tax-credit-allocations

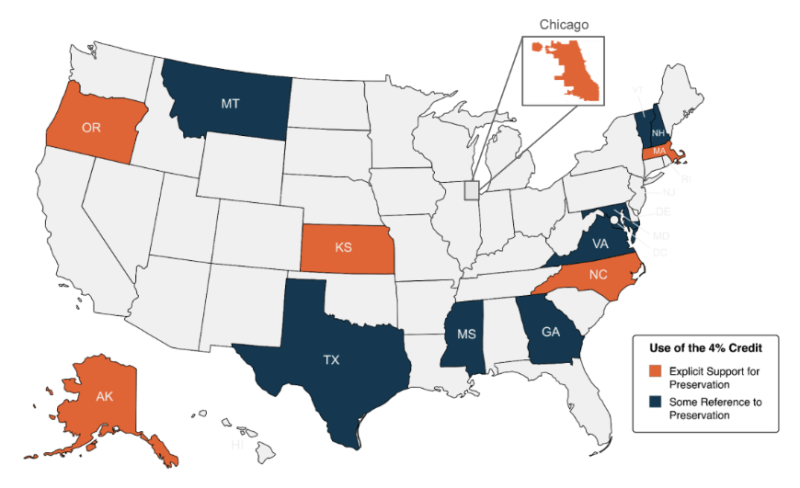

With increasing competition for the 4 percent credit, in part due to rising demand for and state PAB cap limits for both new construction and preservation, NHT’s analysis assessed if any QAPs explicitly encourage or prioritize preservation of existing affordable housing. Tools that are commonly used to promote preservation in the competitive 9 percent credit include scoring incentives, set asides, or basis boosts, which give preservation projects an advantage. The analysis of QAP language found that at least six (6) QAPs clearly identify preservation/rehabilitation as a priority use or make preservation/rehabilitation projects only eligible for the 4 percent credit. At least eight (8) QAPs make some reference to preservation in the context of 4 percent financing, though typically without formal incentives or strong policy direction.

Figure 1: QAPs that Encourage the Use of the 4 Percent Credit for Preservation

Examples of QAPs with explicit language encouraging the use of the 4 percent credit for preservation include:

Written QAP policies provide important insight into state priorities, but they do not always align with how preservation through the use of the 4 percent credit is supported in practice. Many agencies rely on internal knowledge about how their credits are best used, often shaped by state-specific housing conditions, political context, and implementation practice. Even when preservation is not clearly prioritized in the QAP, NHT found several states that do allocate equal or greater amounts of their 4 percent credits for preservation projects over new construction. Each differs significantly in how they allocate PABs and evaluate 4 percent applications in practice.

Without direct engagement with HFAs, the lack of clear QAP guidance and transparent bond allocation processes makes it difficult to assess how states are prioritizing the 4 percent credit for preservation. This inconsistency creates ambiguity for developers seeking to use the 4 percent credit, particularly when preservation projects are perceived as less aligned with the formal incentives or scoring systems laid out in the QAP. As competition for PABs and the 4 percent credit increases, the structure of QAP application processes and the clarity of state priorities will play a larger role in shaping preservation outcomes.

You can read NHT’s Infobrief on Preservation and the 4 Percent Credit here. Learn more about the connection between 4 Percent Credits and Private Activity Bonds, how QAP application structures impact the allocation of the 4 Percent Credit, and QAP policies in practice.

Check out NHT’s Infobriefs across the 9 percent Housing Credit program on our website here: https://nationalhousingtrust.org/strengthening-low-income-housing-tax-credit-allocations