Year End Season of Giving

Support affordable housing as we close out 2025.

National Housing Trust (NHT) received $460,000 from Wells Fargo Foundation to launch a pilot eviction prevention program. Rental Emergency Lifeline/Eviction Fund (RELiEF) was created to help low income renters stay housed in Washington, DC when facing a one-time financial emergency. NHT partnered with Housing Counseling Services (HCS), a DC-based tenant counseling organization, who conducted resident outreach and counseling for the pilot. RELiEF enrolled one hundred and three (103) DC residents in 2023. The program offered enrolled residents up to $1,800 ($600 for 3 months) for on-time rent payments to enable residents to build savings accounts to avoid future rental emergencies. This Update details the evolution of the program through various challenges, including the COVID pandemic and its economic aftermath. It also shares the experience of one of the program's clients and outlines results and lessons learned from the implementation of the program.

The idea for RELiEF arose from reading Matthew Desmond’s 2016 book Evicted which demonstrated that eviction is not just a condition of poverty, but also a cause of poverty. Data that Desmond compiled showed that evicted tenants often owed less than one month’s rent. This reality, coupled with the statistic that 37% of Americans cannot handle a $400 emergency expense, prompted NHT to design this pilot program to avoid unnecessary evictions. Many Americans are one medical bill or car problem away from housing precarity and NHT believed that a small financial intervention could avert a painful cascade of eviction and its consequences.

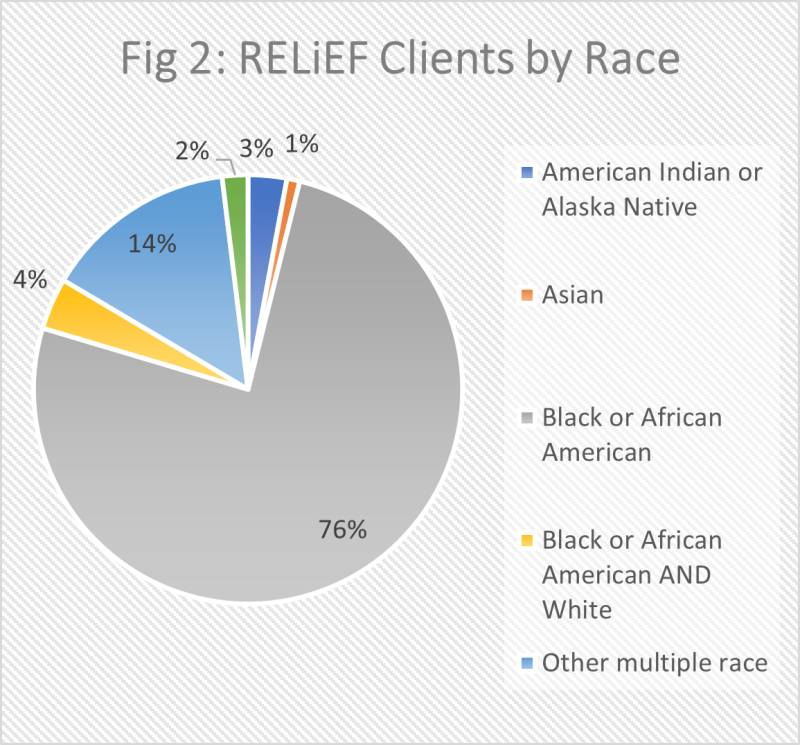

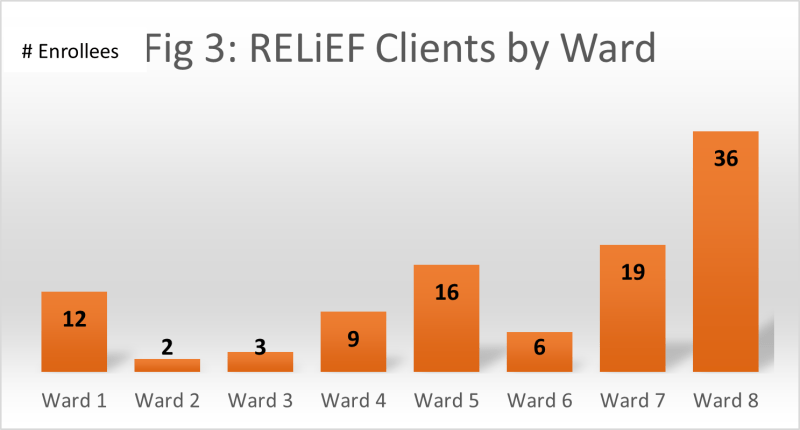

NHT originally applied to pilot RELiEF through the Enterprise and Wells Fargo Foundation’s 2020 Housing Affordability Breakthrough Challenge. NHT was a finalist in the Challenge but unsuccessful in winning, though Wells Fargo followed up with pilot funding to test REliEF separately. RELiEF was initially designed to focus on communities East of the River in Washington, DC which are predominantly Black and face high rates of residential instability. As housing counselors who regularly work with residents in these neighborhoods, Housing Counseling Services (HCS) signed on to administer and support clients in the program.

RELiEF intended to engage landlords in preventing evictions. Evictions are costly for landlords – filing and serving a complaint, paying an attorney, and turning over a unit can cost between $3,000-$9,000 and often takes eight months to process in DC courts. W.C. Smith, a major landlord in DC, signed up as a program partner to pilot RELiEF in their East of the River buildings. W.C. Smith strongly agreed with the pilot’s premise that both tenants and landlords stand to benefit from an eviction prevention program.

The initial RELiEF design offered a one-time payment to renters who experienced an emergency and fell behind on rent in order to cover a rent shortfall. This was targeted for renters who typically paid rent on time but lived on a tight margin. The renter would be enrolled in case management with HCS to receive financial coaching and access to a 3:1 matched savings plan. For each month that a renter paid their rent on time and put money into their savings, they would receive a payment from RELiEF into the matched savings plan (up to $50 per month). Additionally, Pepco, DC’s utility company, would provide the renter with a free energy audit and a referral to the city’s energy and water efficiency programs to decrease utility bills. At the end of the program (12 months), if enrollees committed to saving $25 a month, they would have $1,200 in savings.

Additionally, if a resident continued to pay rent on time for those 12 consecutive months, the landlord would agree to repay the amount of back-rent that RELiEF covered to NHT. This funding would then be recycled back into the program. This repayment would allow the initial investment to revolve and help more families and landlords avoid eviction.

This original RELiEF model was developed in early 2020 and rollout of the program was significantly impacted by the start of the COVID-19 pandemic and associated emergency housing policy interventions. To avoid a massive wave of evictions and housing instability because of the health emergency, the federal government infused an unprecedented amount of rental relief funding. The District received $200 million from the December 2020 federal relief legislation and $152 million in American Recovery Plan funds to support residents to cover their rent or utilities when facing pandemic hardships. Additionally, there were federal and local eviction moratoria put in place to keep individuals housed during the state of emergency. These emergency funds provided substantially more assistance than RELiEF could and did not come with the counseling requirements. This made enrolling participants in RELiEF infeasible while other federal and local programs remained active.

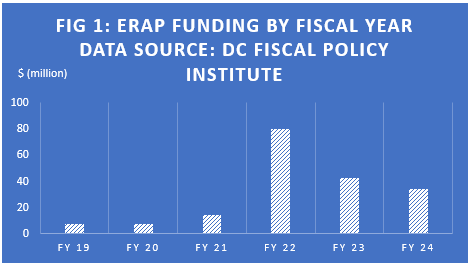

From 2021-2022 there were several attempts to rework the program to adapt to the new economic circumstances, but ultimately the program proved unnecessary while there was so much federal and local funding available to tenants through STAY DC and Emergency Rental Assistance Program (ERAP). Figure 1 shows the significant increase in ERAP funds available after the pandemic began. The influx of government aid and eviction moratorium were fundamental in supporting struggling tenants to stay housed during the early stages of the pandemic.

In early October 2021, the eviction moratorium in the District expired. Shortly after, STAY DC stopped accepting applications. ERAP received additional funding and was able to cover the short-term gap for many residents as federal programs declined. Then in FY2024, ERAP funding was reduced by $10 million and eviction courts reopened. NHT and HCS chose to officially re-launch RELiEF in Summer 2023, when DC’s rent support was drastically reduced for the first time in two and a half years.

At the same time, District landlords experienced a new set of challenges, most significantly a substantial number of tenants delinquent on rent. DC is an expensive city to live and rent in, even before the pandemic or inflation; households that work and have a steady income struggle to make ends meet. While many tenants were still struggling from pandemic related challenges, the sudden loss of rental relief, and a significant inflation increase of 5% in summer 2023 resulted in substantially higher cost burdens for tenants. The result was high non-payment of rent rates that cause economic hardship for landlords. While evictions had resumed, the case backlog meant that many evictions cases were taking over a year before being brought to court.

In re-launching the program, NHT and HCS modified program parameters with the core goal of supporting tenants in re-establishing on-time rental payments. Rather than aiding during a rental emergency, RELiEF now focused on renters who had experienced and recovered from a rental emergency in the last 12 months. The program offered enrollees who paid on time incentive payments that were intended to help the household build savings as a buffer from future crises.

Under the new design, to enroll in RELiEF, residents must meet the following eligibility criteria:

To support the program’s new aims, RELiEF did not incorporate a match component. Qualified renters were enrolled in the program for three months. If they could demonstrate on-time rental payments at the beginning of each month, they would receive a $600 payment (up to $1,800 total). If they were unable to demonstrate on-time rental payments, they could either leave the program or try again the following month. At the start of the program, enrollees were also required to engage in a one-on-one meeting with a housing counselor to develop a budget and savings plan.

While the program was modified from its initial design, RELiEF remained an eviction-prevention program premised on the idea that getting tenants on track with their rent would help prevent evictions down the line, benefitting both tenants and landlords. The revised RELiEF was designed as a tenant incentive program rather than a payment to cover a one-time rent shortfall so did not extensively involve landlords. As a result, the landlord repayment and revolving fund were eliminated from the program.

HCS manages a variety of programs that serve renters in the DC area and used their relationships to identify enrollees for RELiEF. The revised program requirements, especially the $0 or near $0 rental balance at time of enrollment, made it difficult initially to find qualifying renters. Most of the individuals HCS initially contacted had a rental balance which made them ineligible. Of those who were current, many could not document a rental emergency they had experienced within the last 12 months or that their rent accounted for less than 50% of their income.

Small modifications and additions to the original program requirements were needed to accommodate the circumstances of many potential enrollees of the program. For example, residents who had payment plans with their housing providers could be eligible for payments as long as they paid their payment plan amount along with their monthly rent in accordance with their agreement. Some applicants had agreements with their housing provider that allowed rental payments to be made past the 10th day of the month in accordance with the tenant’s income schedule. Such agreements, if provided in writing, were deemed acceptable for the RELiEF program.

For applicants who exceeded the 50% rent-to income ratio, exceptions could be made if they could demonstrate at least 3 months of on-time rental payments without additional assistance. Additionally, the definition of rental emergency was broadened beyond just a demonstrated rental balance to include tenants with a record of habitually late payments. In two cases, documentation that the applicant had fallen severely behind on other housing-related expenses such as electric bills was accepted as proof of a rental emergency.

These modifications and flexibility with program requirements enabled applicants to enroll in RELiEF expediently between June and November (2023) with most enrollees joining the program in August and September. Many of the enrollees were former ERAP beneficiaries who were current with their rent at the time of contact and enrollment. The RELiEF program was able to connect and encourage these residents with financial incentives and support to maintain on-time rental payments going forward.

In total, 103 DC residents enrolled in the RELiEF pilot. Enrollees shared basic demographic information, which is aggregated below.

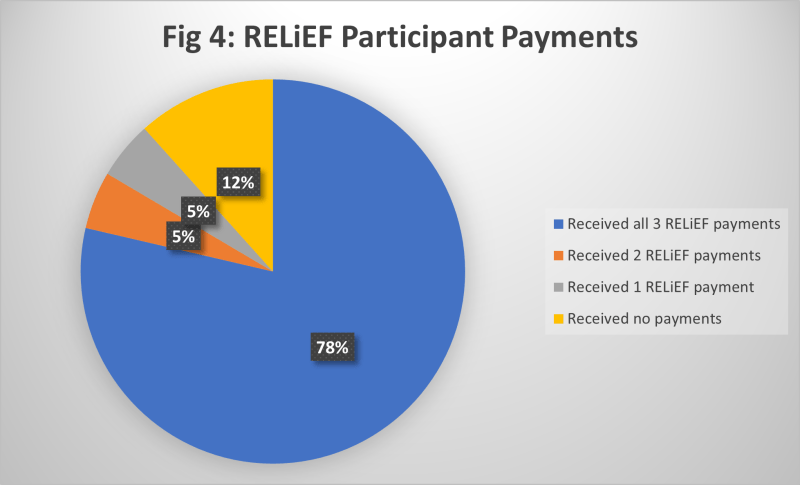

Of the 103 participants, 81 (approximately 78.6%) showed proof of on-time rental payments while enrolled and received all three of the $600 incentive payments. Five (5) participants (approximately 4.9%) received two out of the three potential $600 incentive payments, and another five (5) or 4.9% of participants received only one of the three potential payments. Twelve (12) of the 103 participants, or 11.7%, did not provide proof of on-time rental payments and did not receive any payments through the RELiEF program.

During sessions with housing counselors, participants reviewed their credit reports and created a customized budget and housing, and savings plan for future use of the incentive funds. Most participants stated that they intended to use RELiEF funds to create an emergency savings fund to remain up to date with rental payments in the face of unanticipated expenses. Some cited addressing specific emergencies such as repairs to their vehicles needed for transportation to work. Several participants who received a significant portion of their income towards the middle or end of the month stated that they used the funds to make an up front rental payment at the beginning of the month to get on an on-time, first of the month, payment schedule.

The RELiEF program positively impacted many participants’ ability to save and weather unexpected expenses so that future emergencies would not negatively impact their housing stability. Mr. Zavala’s and Mr. Barnes’ stories illustrate the impact of the program.

RELiEF Client – Mr. Zavala

Mr. Argueta Zavala describes himself as a family man with a wife and a son; he works in landscaping which has seasonal impacts for his income. Shortly after Mr. Zavala enrolled in RELiEF, he and his family experienced some difficult financial times due to his slower season at work as well as an unexpected medical expense. He had accrued a rental balance, making him initially ineligible for payment from the program. Mr. Zavala met with a case manager to review his budget and discuss steps he could take to increase his income in the short term. The case manager also helped Mr. Zavala come up with a plan to address credit card debt that he had accumulated. Mr. Zavala expressed interest in continuing with the RELiEF program and was motivated to take the steps to receive the incentive payments.

By the start of the following month, Mr. Zavala came to his case manager with a ledger to demonstrate that he had caught up on rent and proof that he had made his monthly payment on time. He was then able to receive the first $600 incentive payment and went on to receive payment for the following two months.

The program helped Mr. Zavala to get current on his credit card accounts and build a cushion to face the coming slow season in his work. After the program, he expressed that counseling sessions helped him implement a better system to stay on top of his bills long term and the additional support kept him from falling behind at a vulnerable time for his family.

RELiEF Client: Mr. Barnes

Mr. Travis Barnes fell on hard financial times early on in 2023 and was struggling to keep his head above water when he applied to the RELiEF program. In meeting with his case manager, Mr. Barnes expressed a desire to open an emergency savings fund and improve his credit score to purchase a home. He was excited that the program would allow him to save more while also paying down some debt. With the help of his case manager, he received valuable insight and actionable next steps to get him closer to his housing and financial goals. During the three months of the program, Mr. Barnes was able to open a savings account, reach out to creditors to fix issues on his credit report, and commit to saving $200 per month.

As of mid-January 2024, Mr. Barnes has put an additional $1,000 into his emergency fund and paid down additional debt to increase his credit score. Mr. Barnes feels that in 2-3 years he will have enough for a down payment and plans to use DC’s downpayment assistance program, HPAP, to buy a home when his credit score improves a little more. He stated that he is grateful to have been a part of the RELiEF program and that saving for an emergency and for his future goals likely would not otherwise have been possible in his situation.

We had two major takeaways from administering RELiEF:

Follow up outreach with participants of the RELiEF program is planned for three, six, and 12 months after completion of the program to gather data on the program’s long-term effectiveness in incentivizing on-time rental payments. During enrollment, participants authorized us to review rent ledgers and credit reports up to 12 months after joining the program to gauge the overall impact on participants’ credit. This information will show if individuals are continuing to pay rent on time. A follow-up survey will also help understand what RELiEF funds were used for, and if the funds enabled participants to create a savings fund to buffer them from the impacts of unanticipated emergency expenses. These results will help evaluate the long-term effectiveness of RELiEF and provide information for future iterations of the program.

RELiEF was initially conceived to help low-income Washington, DC renters facing a rental emergency to avoid an eviction. With the rental delinquency crisis caused by the COVID-19 pandemic, inflation, and the cutoff of federal relief funding, the program specifically sought to incentivize on-time rental payments and help enrollees develop a budget and savings plan.

The success rate of the program was high, with nearly 80% of participants paying their rent on- time for all three months. The entire cohort of enrollees demonstrated difficulty paying rent at some point in the previous 12 months, making this payment rate a significant achievement. Overall, the high success rate of participants indicates that case management in conjunction with a financial incentive is an effective approach to helping people save for emergencies and make on-time rental payments.

Falling behind on rent is not a reflection of poor decision-making or laziness, but rather an indicator of how many people are struggling economically and must shift financial priorities to meet unexpected needs. Households experiencing a rental emergency, especially coming out of the COVID-19 pandemic, may need additional support to make ends meet. Wells Fargo’s generous funding of the RELiEF program helped test one model to support these households. Additional data about the effectiveness of RELiEF and tweaked program design will inform future versions of the program. This support can go a long way to avoiding eviction and the detrimental consequences of an eviction.

NHT received $460,000 from Wells Fargo Foundation to launch a pilot eviction prevention program, Rental Emergency Lifeline/Eviction Fund (RELiEF) ,to help low income renters stay housed in Washington, DC when facing a one-time financial emergency. NHT partnered with Housing Counseling Services (HCS), a DC-based tenant counseling organization, who conducted resident outreach and counseling for the pilot. RELiEF enrolled 103 DC residents in 2023. The program offered enrolled residents up to $1,800 for on-time rent payments to enable residents to build savings accounts to avoid future rental emergencies.