Year End Season of Giving

Support affordable housing as we close out 2025.

The sale and/or conversion of affordable housing to market-rate housing remains a threat to both housing preservation and residential stability. In a country with a shortfall of roughly 7 million units available to the lowest-income residents, preserving existing affordable units is critical – and even more impactful when coupled with permanent affordability. Through our real estate development efforts and policy advocacy, NHT aims to preserve existing affordable housing and provide low-income residents with safe, stable, affordable and resilient homes. Two policy tools critical to affordable housing preservation – Washington, D.C.’s Tenant Opportunity to Purchase Act (TOPA)* and the nonprofit right of first refusal (ROFR) in the Low Income Housing Tax Credit (Housing Credit) program -- proved to be key to protecting residents at risk of displacement at Meridian Manor, located in NHT’s home city of Washington, D.C.

Meridian Manor is a 34-unit building, located in the then rapidly-gentrifying Columbia Heights neighborhood of Washington, D.C. Residents are 76% Hispanic/Latino and 21% Black and have incomes at or below 50% area median income.** In 1994, the property was offered for sale by the owner, and was expected to convert to market-rate housing. However, thanks to TOPA, residents had the first right to purchase the property. Lacking the funds to purchase the property directly, residents enlisted the help of NHT, ultimately assigning their TOPA rights to NHT through a partnership to acquire and rehabilitate the building.

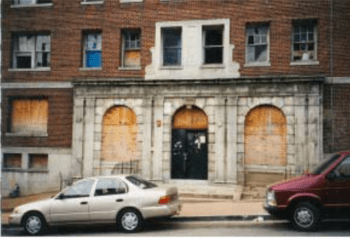

Meridian Manor, prior to ownership by NHT and the tenant's association. Exact date unknown.

Residents had been fighting to remain in their homes for several years and recognized the value of such a partnership with NHT to preserve the property, their community, and their homes. At the same time, NHT recognized the value of partnering with residents to preserve this critical affordable housing supply and improve the quality of the units for the families who live there. Once the purchase was complete, NHT secured Housing Credits to undertake apartment and building-wide renovations at Meridian Manor, maintaining the property as affordable rental housing for the next several years and improving the property’s physical condition.

Per the rules of the Housing Credit program, after 15 years of operating under the program, a qualified party -- either a nonprofit, resident management corporation, government agency, or tenants -- is allowed to utilize a right of first refusal (ROFR) provision to buy out the existing investor partners and purchase the property. Adhering to the terms of the original acquisition , NHT granted the Meridian Manor tenant’s association the right to purchase the property, meaning that after 15 years of renting their units from NHT, the residents could assume ownership of the property themselves. While the ROFR is traditionally assigned to benefit nonprofit partners, this unconventional use served the purpose of transferring ownership and agency to residents. Moreover, it is a highly replicable approach (although long-term commitment) for nonprofit partners to preserve permanent affordability and create wealth for generations to come.

When the residents at Meridian Manor exercised their ROFR to purchase the property in 2017 as agreed, ownership of the property transferred from NHT to the tenant’s association – and from traditional affordable rental housing to a leasehold limited equity cooperative (LEC).*** Using an LEC ensures that the building will remain a permanent source of affordable housing for existing and future residents of Meridian Manor. NHT remains involved to support the residents by continuing to asset management the property; residents are expected to close on the final purchase of Meridian Manor in the next year. Throughout the period of NHT’s ownership, the tenant’s association played a central role in the building’s management, increasing residents’ knowledge, skills, and capacity, ultimately preparing them to take over as owners.

Meridian Manor, after rehabilitation led by NHT and the tenant's association. Exact date unknown.

NHT’s innovative and replicable approach demonstrates the value of finding creative avenues to preserve affordable housing while also delivering opportunities for affordable homeownership for low-income families -- a pathway that remains out of reach far too often. Research has consistently shown that owning one’s own home increases residential stability. This, in turn, leads to better economic and social outcomes, such as improved educational achievement and physical and mental health. However, low-income families face significant barriers to homeownership, including mortgage down payment requirements and low or nonexistent credit scores. According to the National Association of Realtors, between 2010 and 2020, just 27% of all homeowners were low income.**** In Washington, D.C., a racial homeownership gap is also a factor, with a 2022 analysis finding Black and Hispanic homeownership rates at 50.6% each, compared with 70.4% among White residents.

By creatively partnering with residents to utilize a Housing Credit provision traditionally reserved for non-profit entities, NHT is both continuing our mission to preserve affordable housing and supporting the low-income residents at our property. Meridian Manor illustrates how the ROFR mechanism – most commonly used to allow a nonprofit partner to buy out its private equity partners at Year 15 – can also be used to directly benefit the residents. By assigning the ROFR, NHT piloted an innovative way to help low-income residents achieve homeownership and ensure that the property will remain affordable in perpetuity due to the limited equity nature of the cooperative ownership structure.

The residents at Meridian Manor fought for over three decades to preserve their homes and their community. NHT is proud to have played a role in supporting the residents of Meridian Manor to achieve their dreams.

This NHT Update is part of a recurring series focusing on solutions that promote Housing Stability. Each installment will share insights on potential solutions to four major threats to Housing Stability: reduced housing quality, the sale or conversion of affordable housing, climate change, and a lack of tenant protections.