Year End Season of Giving

Support affordable housing as we close out 2025.

As an affordable housing owner, we hear first-hand from our residents about their greatest needs. Increasingly, what we hear is a need for the infrastructure, tools, and skills to reliably and affordably access the internet. As recent years have acutely demonstrated, digital equity -- the concept that everyone, everywhere can benefit from digital technologies, including the internet -- is a key element of any thriving community and essential for households to fully participate in the current economy, receive education from an elementary to post-graduate level, and ensure access to quality-of-life services like healthcare and expanded work opportunities. But we also know that equipping our residents with what they need can be complicated. Achieving true digital equity requires access to affordable and quality broadband internet, internet-enabled devices, and digital skills training.

That’s why in each of the combined 193 units at our R Street and Savannah Apartments, we’ve provided residents with free Wi-Fi provided by a reliable high-speed mesh network. And in our communities across Washington, D.C., Maryland and Virginia, we have developed a device loan program to help bridge the gap of in-home computer access. At our Monseñor Romero Apartments and Savannah Apartments communities, we are excited to pilot an NHT-led digital skills training program featuring the Northstar Digital Literacy curriculum, along with a new Tech Tips digital skills newsletter. To support the expanding digital equity work in our communities, we’ve opened a three-year Digital Literacy VISTA position.

In early 2023, NHT received a Digital Inclusion grant (DIG) from DHCD to support the launch of digital access programs and services at Vintage Gardens, Baltimore. In mid-October, NHT met with the Maryland Department of Housing and Community Development (DHCD) Office of Statewide Broadband and residents of Vintage Gardens to discuss our digital equity programming and services on-site. We were pleased to learn from DHCD that of the dozens of DIG-funded projects, our digital equity programming and services at Vintage Gardens are some of the most comprehensive in the state. We are grateful to partner with DHCD at our Baltimore community and look forward to the continued expansion of our digital equity work across our portfolio.

_________________________________________________________________

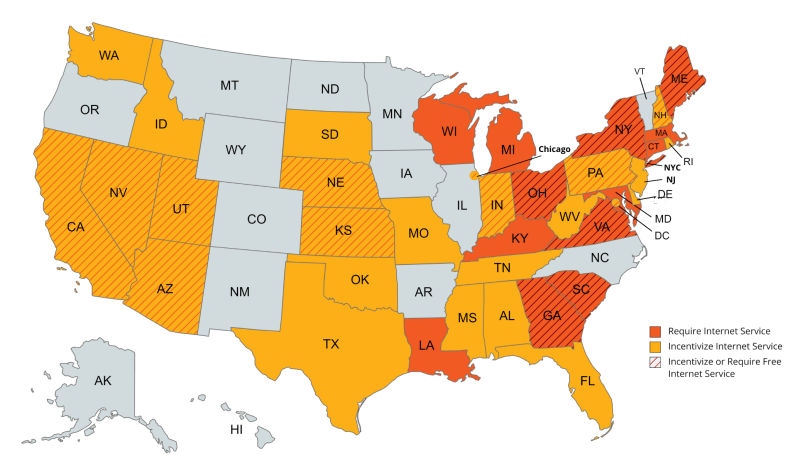

While we are proud to help meet the needs of our own residents, we know the digital divide affects low-income renters across the country – not just those who live in NHT-owned properties. State and local Housing Finance Agencies (HFAs) have an important opportunity to advance digital equity for the two million households residing in Low Income Housing Tax Credit (Housing Credit) properties by including incentives or requirements within the Qualified Allocation Plan (QAP) to best meet residents’ needs. A recent analysis conducted by NHT assessed how HFAs promote digital equity in their states through the administration of the Housing Credit program. Specifically, we examined how 53 HFAs (all 50 states, plus DC, New York City and Chicago) incentivize or require program applicants to:

Build broadband infrastructure capable of high internet speeds

At least 34 HFAs require or incentivize the installation of broadband infrastructure in both new construction and substantial rehabilitation properties receiving an allocation of Housing Credits, and only four of these HFAs encourage higher internet speed standards than those required by the FCC.

Supply affordable in-unit and community internet service

At least 39 HFAs go beyond broadband infrastructure by requiring or incentivizing internet service in units and/or in community spaces. Among these 39 agencies, 18 require internet service provision to be free of cost to tenants (see Figure 1 below).

Provide access to internet-enabled devices

At least 20 HFAs explicitly encourage developers to offer access to devices through computer rooms, business centers or other publicly available opportunities for access, while three states incentivize device loan programs.

Offer opportunities for digital skill-building

Digital skills programs are explicitly encouraged by 8 HFAs.

Figure 1: States that Require or Incentivize In-Unit and/or Community Internet Service (as of June 2023)

_________________________________________________________________

We understand the challenges that come with navigating QAP requirements – as a real estate developer, we do it ourselves to compete for Credits. We also know it is possible and necessary to prioritize the needs of our residents, including digital equity. As HFAs across the country contend with the digital divide, which puts underserved and low-income communities at a disadvantage, they play a critical role in ensuring that Housing Credit residents have access to affordable broadband internet, internet-enabled devices, and digital skills training. For a more detailed analysis of how HFAs include digital equity in their QAPs, see our Infobrief. NHT continues to work with both HFAs and affordable housing owners to share best practices, lessons, and solutions to promote housing stability and to better meet the internet needs of low-income renters. Digital equity not only strengthens community resiliency and promotes housing stability, but also supports NHT’s mission – equipping communities for a sustainable, equitable future by preserving and modernizing existing homes so that everyone, everywhere, can be proud of where they live.

This NHT Update is part of a recurring series focusing on solutions that promote Housing Stability. Each installment will share insights on potential solutions to four major threats to Housing Stability: reduced housing quality, the sale or conversion of affordable housing, climate change, and a lack of tenant protections.